August 19, 2024

Different Types Of Trusts: Which Is Ideal For You?

How To Choose The Right Will Certainly Paper For Your Will This might have info obtained from third-parties, including ratings from credit rating ratings companies such as Requirement & Poor's. Reproduction and circulation of third-party web content in any kind is restricted other than with the previous written approval of the relevant third-party. THIRD-PARTY MATERIAL SERVICE PROVIDERS PROVIDE NO EXPRESS OR SUGGESTED GUARANTEES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR HEALTH AND FITNESS FOR A PARTICULAR FUNCTION OR USE. Credit rating scores are declarations of point of views and are not statements of reality or referrals to purchase, hold or sell protections. They do not deal with the viability of securities or the suitability of safety and securities for financial investment purposes, and ought to not be depended on as financial investment advice. Every count on established can be categorized as either a living count on or a testamentary count on, relying on the time of its creation.Should I Make Use Of A Legal Or Attorney-drafted Will?

The 5 best nuts for diabetes - Medical News Today

The 5 best nuts for diabetes.

Posted: Thu, 31 Jan 2019 00:08:36 GMT [source]

Kinds Of Trust Funds Frequently Asked Questions

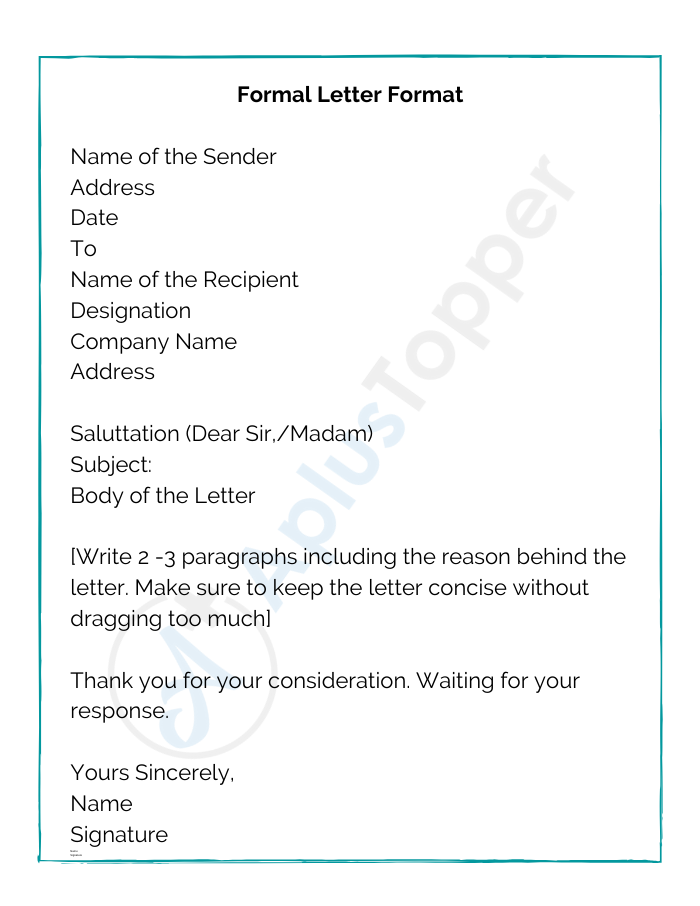

This is generally an official will that sets out the essentials of that will certainly inherit but does not have more complexities. Usually, you name an administrator that manages the probate procedure and manages possessions till they are transferred to recipients-- a recipient is a person who inherits home after you pass away. If you intend to have an estate preparation binder, it does not take long for documentation to start running together.One Of The Most Trusted Name In Online Estate Preparation And Settlement

After you pass, the possessions in a living trust are moved to your beneficiaries. A revocable count on permits the grantor-- the person that produced the trust fund-- to alter or finish the trust at any type of factor throughout their lifetime. Revocable counts on are also referred to as living counts on or revocable living counts on. Finding out about your choices can aid you prepare for your enjoyed ones' future. Let's take a look at a few of the most typical types of trusts to take into consideration during the estate preparation procedure. There are many different sorts of depends on that a grantor can make use of for their small beneficiaries. The regards to the depend Estate Laws by Region on can be extremely thorough and include details directions to give appropriate care based upon your pet dog's requirements. You need to name a trustee that will hold the cash and a caretaker that will certainly utilize the money gave based on the depend on's terms to take care of your family pet (this be the same individual if you want). When someone is handicapped, they frequently get means-tested federal government advantages. As an example, eligibility for both Supplemental Safety Earnings (SSI) and Medicaid can be lost if a person has way too many properties. An unique requirements count on permits you to supply supplemental funds for a person receiving these or various other benefits without causing them to shed their federal government help since the possessions are not in their name. You'll require to name a charitable beneficiary or a. certifying charity that will get the count on possessions. The surviving partner possesses the marital depend on, though they can get income from the family members trust throughout their lifetime. It's important to understand that possessions in a testamentary count on constantly go through the probate process. As a result, your estate becomes an issue of public document, which suggests your beneficiaries will lose several of the personal privacy that features other sorts of depends on. Typically, the possessions in a living count on transfer to your beneficiaries after you pass away. To aid make the estate planning process easier, we damage down some of one of the most usual kinds of count on funds in this overview. For instance, you can specify that beneficiaries might just get revenue from the assets as opposed to accessibility the entire major amount. Doing so ensures the beneficiary has a secure, long-term source of financial backing. Nevertheless, it eliminates financial control from the beneficiary and can be made complex to handle. Regardless of its lack of versatility, irreversible trust funds provide possession safety and tax benefits, making them an attractive kind of depend on for individuals with large or intricate estates.- It ranks insurance companies on a range of 1 to 100 (where 1 is the most affordable) in an initiative to reduce confusion over rankings since each score company makes use of a various range.

- These pre-arranged trust fund accounts are suggested to be established by your named trustee, who will certainly handle your assets and trust fund make up you, after you die.

- You can withdraw a long lasting POA at any time, as long as you're of sound mind.

- In it, you can additionally identify a specific encouraged to choose in your place.

- A depend on is an estate preparation tool to transfer assets to your heirs, likewise known as beneficiaries, upon your death.

What is the typical age an individual will live to?

Life expectancy for males and females

A male child born in the USA today will certainly live to be 73.5 years of ages on average. This puts the male residents of the US in 40th place in this position. Typically, United States women are 5.8 years older, reaching an age of 79.3.

Social Links