Pour-over Wills In California The Law Firm Of Kavesh Small & Otis, Inc

Pour-over Wills Jacksonville Estate Preparation Attorneys Law Workplace Of David M Goldman At Count on & Will, we have actually made it very easy to set up trusts and wills through our on the internet solutions. All you have to do is get going on our website and undergo our assisted procedures with simply a couple of clicks! We additionally have support specialists that can assist you along the road need to you have any questions. Larger estates will occasionally use irrevocable trusts to minimize the tax obligation worry for beneficiaries, specifically Protecting Assets from Creditors if they are likely to be based on estate tax. When grantors move assets to an irrevocable count on, the assets come completely under the control of a trustee.Best Online Will Maker - Money

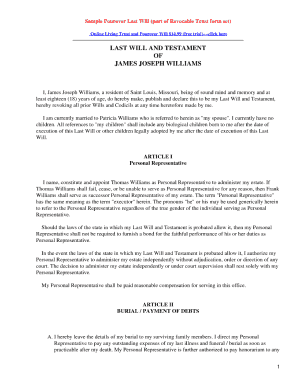

Best Online Will Maker.

Posted: Fri, 11 Nov 2022 08:00:00 GMT [source]

Included Property

This permits recap probate procedures, which are much cheaper and faster than formal probate procedures. Instead, the pour-over will certainly direct that these possessions most likely to the depend on and be dispersed according to the grantor's intents-- though not necessarily as rapidly as if they had actually remained in the trust to begin with. You may have seen recent news protection of clients of financial solutions companies coming down with social engineering rip-offs. Scammers pose a relied on business to convince their targets into exposing or turning over sensitive information such as insurance coverage, banking or login qualifications. This scamming can happen using text, e-mail or web sites established to appear like the trusted company.The Distinction Between Normal Wills And Pour-over Wills

- That implies that any kind of home headed toward a living depend on may get hung up in probate before it can be dispersed by the trust.

- If the count on is a guarantor trust fund, the maker of the count on covers the earnings tax of count on assets, and the recipient will certainly not owe revenue taxes on circulations.

- Although a revocable living depend on is frequently utilized instead of a will, both are not mutually special.

- Without a will, when you pass away, your accounts and building will certainly be dispersed according to state law-- which could end up being very various from exactly how you desire them to be dispersed.

- A pour-over will certainly is a particular legal device that is just useful as part of a comprehensive estate strategy.

- A revocable depend on doesn't shield the grantor's assets from creditors, which indicates if the grantor is sued, the count on properties can be ordered sold off to satisfy a judgment.

The Function Of Trustee

Discover why you may require this estate preparation device and just how it works. Another benefit of pour-over wills is that they provide more personal privacy than utilizing a typical will. Assets that undergo probate become part of a court's documents and can be quickly discovered by any type of member of the public. This may force the living depend take place for months after the death of the will and trust. manufacturer. In contrast, building left directly via a living count on can generally be dispersed to the recipients within a few weeks after the count on manufacturer's fatality. A revocable trust gives much more versatility since you're able to make revisions such as transforming recipients. With an irrevocable trust fund, you surrender all civil liberties to the possessions after they're transferred to the trust.Why use a pour-over will?

There are a variety of disadvantages to using Mirror Wills, specifically where a couple has children. Below's where the risks to your kids's inheritance come in: Firstly, as the Wills are different legal records', either party is cost-free to change their Will certainly at any moment. A pour-over will is an invaluable file for anybody who has actually produced a living depend on as component of their estate plan. It's a specialized last will and testimony, designed to capture properties that have actually not been retitled or moved into your living trust, & #x 201c; putting & #x 201d; them into the depend on upon your death. A revocable depend on and living depend on are different terms that explain the very same point: a count on which the terms can be transformed at any moment. An unalterable trust fund defines a trust fund that can not be modified after it is produced without the recipients' consent or court approval, and perhaps both.