Pour Over Wills Under The Law Estate Preparing Lawful Center

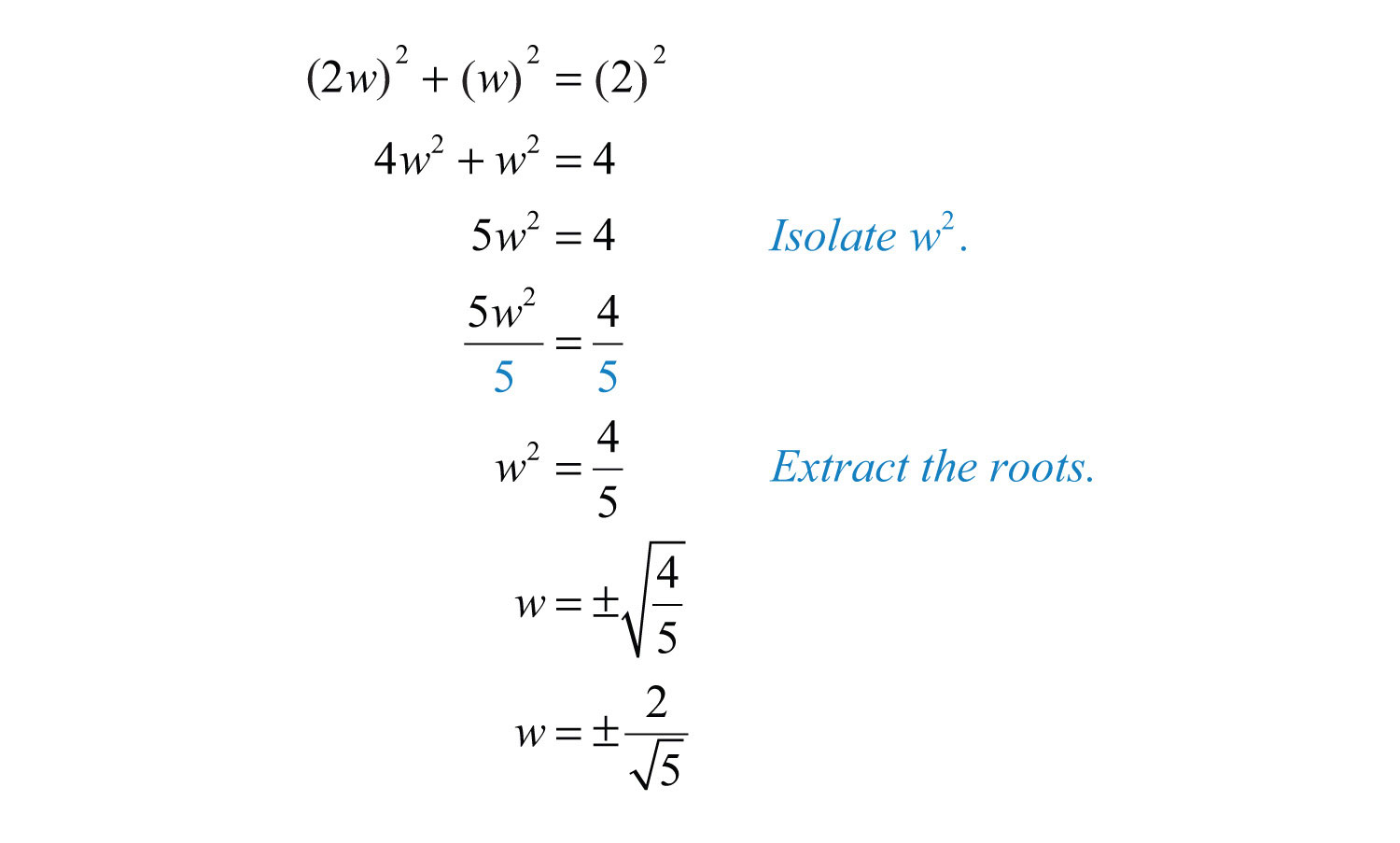

Pour-over Wills In California The Law Firm Of Kavesh Minor & Otis, Inc When you create a pour-over will, you are letting the state know that you desire any non-trust possessions to be transferred into your living trust fund after you have passed away. You are, effectively, allowing your non-trust assets to put over into the count on. Because a pour-over will is still a will, that record may need to experience the probate process. Probate is not as quick as simply having everything in a trust to start with, yet probating a pour-over will certainly is commonly much easier compared to a requirement will.Estate Planning with Portability in Mind, Part II - The Florida Bar

Estate Planning with Portability in Mind, Part II.

Posted: Wed, 04 Apr 2012 07:00:00 GMT [source]

What Is A Pour Over Will In A Living Trust?

Or the trustee might be licensed to make distributions at numerous periods. In short, a pour-over will certainly specifies exactly how properties you didn't move to a living trust during your life will be moved at fatality. You may not recognize that you have actually inherited properties from a dead family member.Using A Pour-over Will And Revocable Rely On Estate Preparation

UTATA especially dictates that any kind of probate assets transferred to a living trust fund be dealt with identically to other assets in the trust, hence conserving the probate court extensive time and cost. Some jurisdictions require that if the trust fund record is changed, the pour-over will certainly have to additionally be republished, either by re-execution or codicil. In these territories, if the depend on is withdrawed by the testator and the pour-over stipulation is neither changed nor removed, the pour-over gift gaps.- Using a pour-over will in conjunction with a trust has several benefits and downsides.

- A last will and testimony typically gives particular instructions on which beneficiaries will acquire the possessions of the dead left behind.

- While a pour-over will certainly needs to experience probate, like any type of other will, it likely will consist of relatively couple of assets, and these properties will not have substantial worth.

- Mean an older pair wants to disperse an estate to their kids and grandchildren.

How Do Pour-over Wills Work?

This Will makes sure that the personal rep will certainly transfer any building, not already placed in the trust, right into the count on. This ensures just a single file controls your home, and also acts as a catchall in case, not every property is represented in the trust. It is helpful to transfer as several assets as possible right into your living trust fund so they can prevent probate. A pour-over will certainly must only catch the possessions that slide via the fractures. The main downside of utilizing a pour-over will certainly in conjunction with a living trust is that possessions recorded by the will needs to experience the typical probate process. Every so often, possessions are not transferred appropriately from the private to the trust. The probate process made use of for a provided estate depends upon the size and complexity of the estate. If your pour-over will requires to move just a percentage of home to one recipient (the depend on), a streamlined probate procedure is possibly all that will be needed, with little or no court participation. Estate plans usually pair pour-over wills with living trust funds, which call for that grantors transfer possessions to them before their fatality. If you have actually set up your living trust/pour-over will Additional hints certainly mix thoroughly, the huge bulk of your assets will belong to the count on and as a result immune from probate. The good news is, Betty covered her bases by additionally developing a pour-over will that mentions that the rest of her estate ought to transfer to her living trust upon her passing away. When Betty dies, the pension plan account transfers to the trust so that Joe and Lisa can acquire Betty's entire estate smoothly and according to her wishes. Unlike a standard last will and testimony, a pour-over will certainly is not a stand-alone paper, and that's because it needs something to put right into.Why make use of a pour-over will?

There are a variety of negative aspects to making use of Mirror Wills, particularly where a couple has children. Here's where the risks to your youngsters's inheritance come in: Firstly, as the Wills are different lawful records', either celebration is cost-free to transform their Will at any moment. A pour-over will is a vital record for anyone that has actually developed a living depend on as component of their estate plan. It's a specialized last will and testament, created to capture possessions that have not been retitled or moved right into your living trust, & #x 201c; pouring & #x 201d; them into the trust upon your fatality. A revocable count on and living count on are different terms that describe the very same point: a count on which the terms can be altered any time. An irrevocable depend on explains a trust that can not be changed after it is produced without the recipients' authorization or court approval, and potentially both.