Optional Counts On Vs System Trust Funds

Typical Inquiries In Our Inbox: Optional Counts On It is additionally useful where the recipient has a drink, medication or gambling problem and the testator does not intend to gift the cashes to them directly for fear it can aggravate their dependency. This system enables you to ringfence some or all of your Estate, often to support a loved one that is vulnerable or incapable to manage their own events. Or protecting money or assets for liked ones going through a separation or a period of economic instability.Step 3 Calculate The Accumulation Chargeable Transfer

- The trustee( s) need to follow a rigorous procedure when selecting to invest depend on assets.

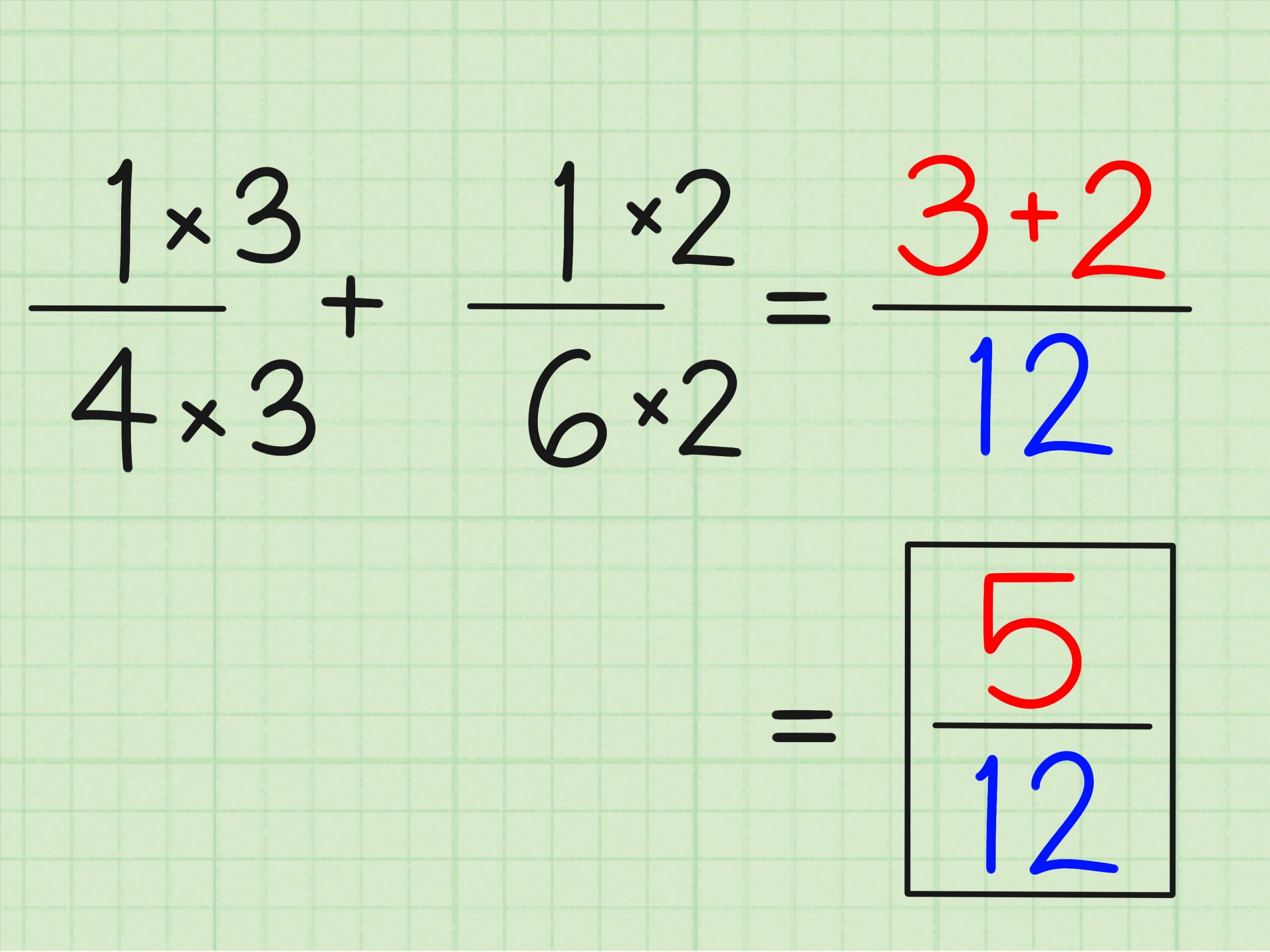

- As the present goes beyond Helen's readily available NRB of ₤ 325,000, an unwanted of ₤ 75,000 occurs and tax due on this amounts to ₤ 15,000.

- The trustee has a lot of discernment over just how the trust fund funds are utilized, and there is no demand for a beneficiary to be notified of all the trust fund decisions.

- Put simply, discretionary counts on are a great estateplanning tool for those beneficiaries that might need extra support managinglarge amounts of cash.

- The price of tax on the departure is a percentage of the price charged at the previous one decade wedding anniversary.

Dealt With And Optional Trusts Under The Legislation

Discretionary trust: how are we taxed on withdrawals? - This is Money

Discretionary trust: how are we taxed on withdrawals?.

Posted: Fri, 15 Jan 2016 08:00:00 GMT [source]

Exactly How Do I Established An Optional Count On Missouri?

This type of trust can aid to avoid mismanagement of assets for recipients. Claim, as an example, that you have an adult youngster who has a history of luxurious investing or adding financial debt. You could set up an optional depend make sure that they still obtain possessions from your estate once you die without giving them free rein over those assets. Discretionary trusts do not take advantage of alleviation on stamp duty, also if the depend on is a 'very first time customer'. Rather, an optional trust will typically be responsible at the greater rate of stamp responsibility. It is necessary to note that where a main house passes to an optional count on, the RNRB will certainly not apply. Nonetheless, the RNRB can be recovered if the home is appointed bent on route offspring within 2 years of the testator's date of death as a result of section 144 of the Inheritance Act 1984. Nonetheless, the trustees are called for to act in the very best passion of the trust and consequently they can decline this demand. Where a major residence passes to a discretionary depend on, the RNRB will not apply. Learn even more regarding how to offer your kids with economic security throughout their life time. At Paradigm Wills and Legal Services, we genuinely appreciate educating individuals on the relevance of making a long lasting power of attorney in Leicester. In an industry commonly loaded with complicated lawful lingo and a conveyor-belt way of thinking, we offer a standard change in just how we provide our wills solutions. Because of the complexity of counts on, it's always advisable to look for specialist professional suggestions prior to setting up a depend on. The entrance cost is also known as the lifetime cost or immediate fee and is examined when the count on is created. Presents right into discretionary count on are classified as chargeable lifetime transfers (CLTs). When setting up a new trust fund you need to take into consideration any type of previous CLTs (e.g. gifts into optional depends on) made within the last 7 years. As long as this total amount does not exceed the settlor's nil price band (NRB) there will be no entrance fee. If it is a couple who are establishing the trust you increase up the nil rate band.Why would you set up a discretionary count on?

A key element of an optional trust fund is that there should be numerous prospective recipients that can take advantage of it. In many cases, Trusts are set up with details terms that instruct the Trustee to disperse funds to beneficiaries on a set timetable. The terms also usually established just how much ought to be distributed. Optional Depends on are one-of-a-kind from other types of Trusts due to the fact that there are no such terms. On each 10-year wedding anniversary, the count on is exhausted on the worth of the trust less the nil rate band readily available to the trust, with the price on the extra being 6%( computed as 30 %of the life time rate, presently 20% ). If the count on value is much less than the nil rate band, there will be no charge. Recipients of an optional count on are not entitled to obtain anything since right. Instead the recipients have the prospective to receive cash and the right to ask the trustees to exercise their discretion in their favour. If an optional depend on is established during the settlor's life time, the possessions within that trust may fall outside their very own estate if they die a minimum of seven years after putting the possessions right into the trust. This will certainly have the impact of decreasing down the overall value of their estate when it is analyzed for estate tax. A life time discretionary trust fund or life interest depend on made to hold cash or financial investments will certainly