August 30, 2024

Optional Count On Wikipedia

Optional Count On Wex Lii Lawful Info Institute The Trustee has full control and is thought about the legal owner, although they can not benefit from the funds in any way. If the settlor dies within 7 years of making a transfer right into a trust, their estate will certainly have to pay IHT on the amount at 40%. In such a situation, the individual taking care of the estate will certainly need to pay a further 20%. If the value of the assets transferred to the trust fund has actually increased because the settlor got it, the settlor might be responsible for Funding Gains Tax (CGT). The trustees are not bound by a letter of desires, but they can take it right into account when handling the estate. Seeking the guidance of a legal, financial or tax obligation expert will certainly assist you exercise whether a Discretionary Depend on is a good suitable for you and your household.Creating a high-performance workplace by tapping into discretionary effort - HR Magazine

Creating a high-performance workplace by tapping into discretionary effort.

Posted: Thu, 25 Feb 2021 08:00:00 GMT [source]

Types Of Optional Depends On Readily Available From Quilter

You have the utmost trust in him, and recognize that he will disperse the funds carefully. In case that your little girl regressions or otherwise is displaying careless habits, your Trustee can stop distributing funds at his discretion until she gets back on the best track once again. Since the trustees have a lot of power, you might wish to give some standards for them to follow. This can be achieved by leaving a letter of desires in addition to your will, laying out the circumstances in which you would certainly like your recipients to receive their possessions. It's worth making the effort to find out more regarding how a Discretionary Trust fund works. Because beyond simply providing for depend on beneficiaries, this lawful structure could have benefits for your own personal situations, monetary circumstance and estate preparation demands.Register Currently For Your Free, Customized, Day-to-day Lawful Newsfeed Service

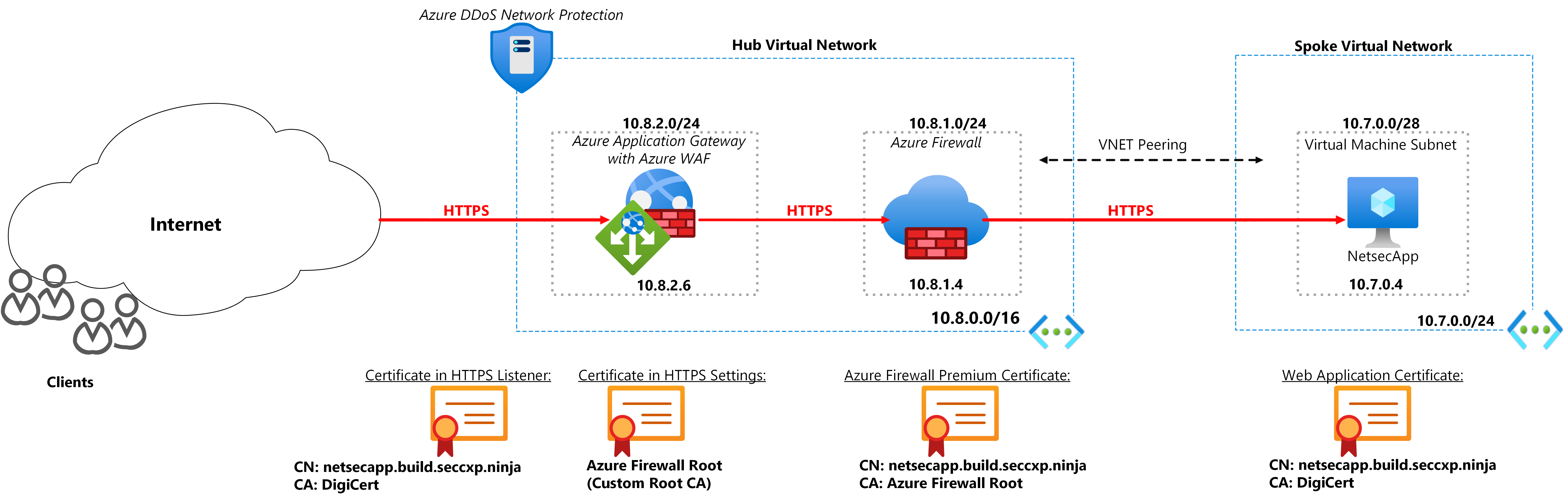

The trustee that manages the depend on can utilize their discretion in identifying when and how depend on assets ought to be distributed to beneficiaries, thus the name. There are various reasons you could consider developing an optional rely on lieu of various other trust fund options. Understanding the pros and cons of discretionary counts on can help you choose if creating one makes sense for your estate plan. As with all discretionary trusts there are no named recipients, simply a checklist of predetermined individuals and various other legal entities who may become a beneficiary. The trustees have complete discernment over whom on the list gain from all or part of the trust property. There are different tax consequences of optional trusts and suggestions need to always be sought and all choices considered before proceeding.Pros And Cons Of Establishing An Optional Depend On

If you have actually not been registered for the SWW participants Location, please contact us. Your personal data will just be used for the functions described in our privacy plan. With Discretionary Trusts, the Trustee can be an individual, a business regulated by family members group and even an expert 3rd party Trustee business. Much like Wills, Discretionary Trusts are a means of handling and distributing family members wide range (you can additionally set up a Trust as component of your Will certainly - this is referred to as a Testamentary Depend On). It is based on Quilter's analysis of the pertinent law and is proper at the date revealed. While our team believe this analysis to be correct, we can not ensure it. The executors will not be able to make use of taper alleviation as the gift was made within 2 years of fatality. First of all we require to recalculate the rate charged at the ten years wedding anniversary, using the present NRB at the date of leave which is assumed as ₤ 406,600. Any type of finance from the depend a beneficiary need to be recorded effectively and by way of a. finance agreement. This could likewise be used to protect funds for a small till they get to an age where they can take care of the money on their own. Where the beneficiary is also a trustee, we would encourage one other trustee is appointed that is entirely neutral to stay clear of any type of problem of passion. Discretionary Counts on vary from Life Passion Counts on because no automatic right to the satisfaction of the revenue or funding of the depend on develops. However, the RNRB might be recovered if the building is selected out to direct offspring within 2 years of the testator's date of fatality-- area 144 of the Inheritance Act 1984. Do not hesitate to review your choices initially with our group of lawyers and will certainly authors in Leicester. Just fill in the type, and we will quickly reach out and assist with everything you need to get started. For more info or suggestions regarding Discretionary Trusts or Estate Preparation in general, please contact us. We aim to supply fresh ideas, clear and uncomplicated explanations, and a solution tailored particularly to you. With you at the centre, we aim to make the will creating procedure as transparent as feasible. It is not feasible for a useful trust or a resulting trust to arise as a discretionary count on. Our expert attorneys have substantial experience in developing and administering trusts for our customers. Most of all, one of the most vital thing is to make sure your Will certainly harmonizes your family conditions and that it provides comfort. Beneficiaries of a Discretionary Count on do Key Processes not have any type of lawful claims over the Trust fund funds.- The trustees can choose which of the recipients obtain a distribution, just how much they receive and when they obtain it.

- This permits the trustee to have discernment over who can take advantage of the trust and the quantity of cash each recipient would get annually.

- It is feasible for the settlor to be appointed as the protector of the trust.

- Any individual is entitled to order a copy of a Will that has actually gone through the probate procedure.

Does a discretionary trust fund have an advantageous proprietor?

Bene & #xfb 01; cial possession of the depend on residential or commercial property exists with the bene & #xfb 01; ciaries. The trustee can likewise be any kind of proficient person over the age of 18 (person) that is not bankrupt or under some other lawful special needs.

Social Links