August 27, 2024

What Is An Optional Count On? Meaning & Faqs

Typical Inquiries In Our Inbox: Optional Depends On Typically the trustees can pick from a vast class of recipients (omitting the settlor) to whom they can disperse the count on funds. The recipients do not have any type of entitlement to the depend on fund thus it does not form component of their estate on divorce, insolvency or fatality. Because of this adaptability the trust funds are potentially subject to an access charge, a 10 annual cost and a leave cost. In some cases optional depends on are referred to as "negotiations" or "pertinent property counts on". An optional trust is a type of trust fund where the trustees are provided full discretion to pay or apply the earnings or funding of the properties for the advantage of one or every one of the recipients.Step 1 Calculate The Notional Life Time Transfer

- The trustee( s) should comply with a stringent procedure when selecting to invest depend on properties.

- As the gift surpasses Helen's available NRB of ₤ 325,000, an excess of ₤ 75,000 emerges and tax obligation due on this totals up to ₤ 15,000.

- The trustee has a good deal of discernment over exactly how the depend on funds are used, and there is no requirement for a recipient to be notified of all the trust fund decisions.

- Put simply, discretionary depends on are an excellent estateplanning tool for those beneficiaries who may require extra aid managinglarge amounts of cash.

- The rate of tax on the departure is a proportion of the rate billed at the previous 10 year wedding anniversary.

What Are The Advantages Of Discretionary Counts On?

Trust funds not just for super rich Business - News24

Trust funds not just for super rich Business.

Posted: Mon, 01 Jun 2015 07:00:00 GMT [source]

Request A Totally Free 15 Minute Suggestions Get In Touch With Any Of Our Legal Services

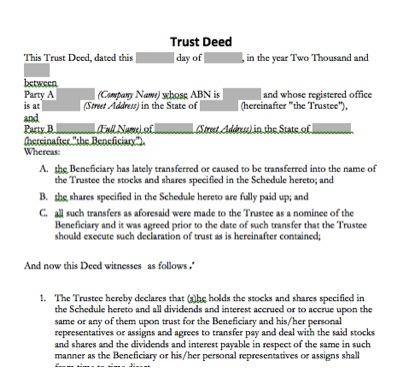

Think about a scenario where the settlor states an optional trust of say ₤ 1 million. A number of years later he is getting divorced and has been asked to mention all his assets. The settlor does not state the depend on fund as this is no longer a property he is the lawful proprietor of. Discretionary beneficiaries have an essential lawful right to have the Depend on carried out according to the terms of the depend on document. The main distinctions in between the sorts of trust are the valuable civil liberties that the recipient may or may not have. This article only takes into consideration UK estate tax and does not take into account various other taxes or local guidelines. The second PET comes to be chargeable as it was made within 7 years of her death. As the second family pet is chargeable, it consumes the NRB and there will certainly be an IHT charge on the CLT of 40%. A count on is a legal plan that entails a settlor, who puts properties into a depend on fund, which is then managed by trustees for the advantage of a recipient or beneficiaries. Different type of properties can be put in a depend on, consisting of cash money, residential property, shares, unit counts on and land. A trust is a legal setup in which assets are handled by a trustee on behalf of one or more recipients. Some might not be depended take more info care of a huge inheritance and there might be a worry that the money will be spent at the same time. This type of trust permits trustees to manage the depend on fund to prevent this from occurring whilst providing the monetary support as and when it is called for. For clients who possess their very own company an optional trust fund can give a useful framework in which to pass on shares in a family service, consequently using defense for the advantage of future generations. It is occasionally described as a household rely on Australia or New Zealand.What are the benefits of a discretionary trust in a will?

Social Links