August 27, 2024

Producing A Will Certainly As A Business Owner In Canada

10 Lawful Requirements For Starting A Small Business Nonetheless, tax obligation can be a complex process for many, making it necessary to employ a lawyer specializing in this part of the regulation. A tax legal representative is an individual who helps companies with tax-related legal matters. A family-owned LLC is a powerful device for handling assets and passing them to youngsters. Moms and dads can keep control over their estate by appointing themselves as the manager of the LLC while supplying substantial tax benefits to both themselves and their children. Due to the fact that estate planning is very complicated, and the guidelines regulating LLCs differ from one state to another, people need to talk to a financial consultant prior to formalizing their LLC strategy. This insurance can assist reduce the monetary influence on business throughout a transitional period and guarantee its continuity till an ideal substitute is discovered or business is transferred to new proprietors.Sole Proprietorships And S Firms: When The Proprietor Passes Away

This insurance policy is required for sure careers such as accountants and monetary consultants. This protects them versus cases for losses suffered by customers as a result of blunders or neglect. Usually other expert consultants determine to take this cover out for their very own assurance in situation their clients wish to sue them. Some people like to take care of Legal Documentation sole traders over minimal business as the business often tends to really feel a lot more individual, particularly if the nature of the job is sensitive. You're developing a company strategy, obtaining your monetary plan in order, and possibly pitching to investors or seeking funding. One thing that can be overlooked however is exceptionally important, is making sure all legal responsibilities are satisfied.Exactly How To Use An Llc For Estate Planning

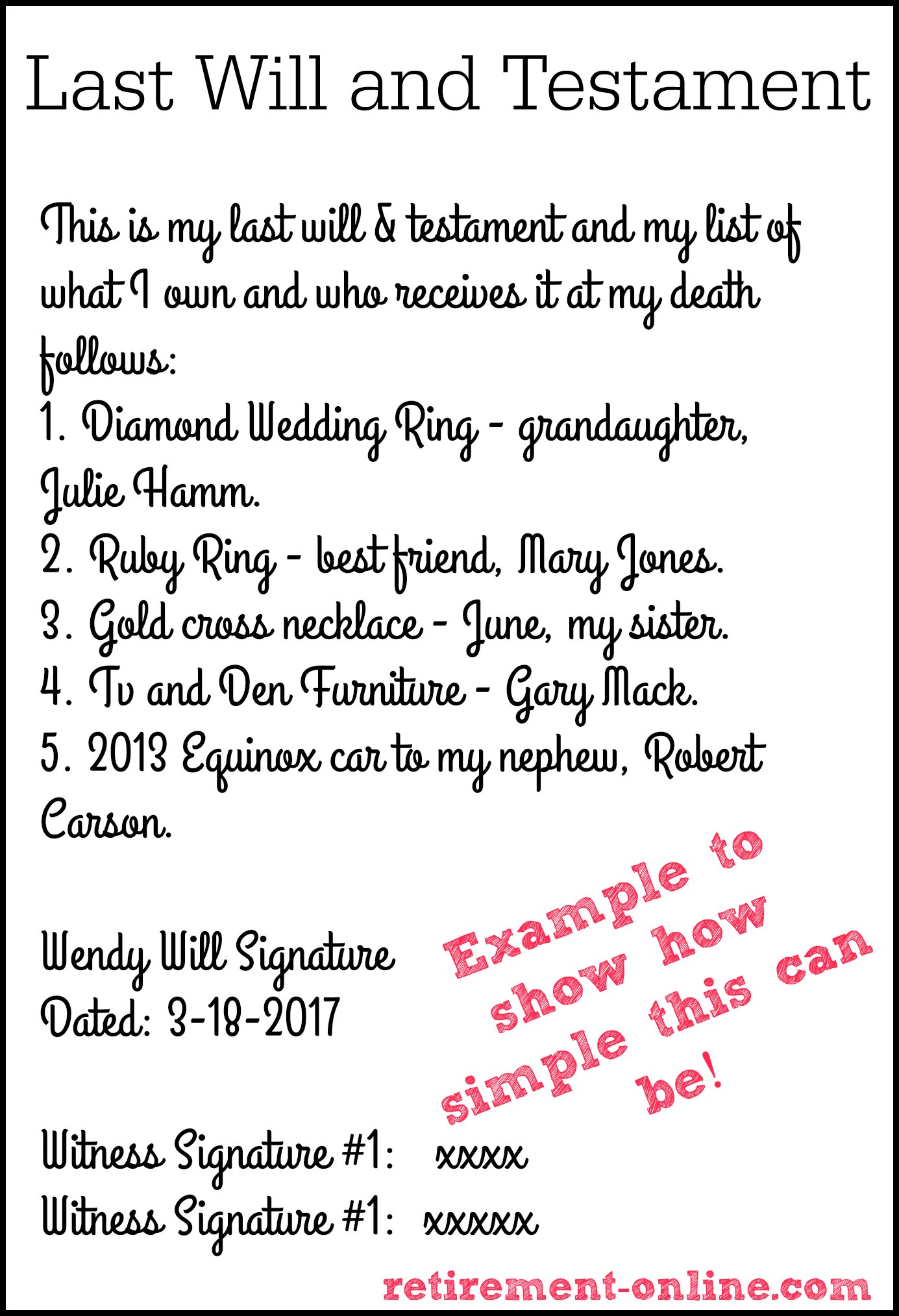

A trusted advisor can help you weigh your options and advise you to make prompt choices. There are particular points a will certainly can not achieve for an individual, such as aid a family members prevent probate or minimize estate taxes. A living will does not have anything to do with the transfer of assets upon death. Healthcare proxies can communicate with the patient's medical professionals to stop unwanted therapies and make sound decisions on their part. Along with effort and time, the probate process involves lawful costs associating with an attorney, the executor, and the court. While there can be extra to an estate strategy than just a will, the will certainly is the presiding paper that a probate court makes use of to guide the settling of an estate. Any kind of possessions that have marked recipients, such as a life insurance policy, certified retirement plan, or brokerage account, are not consisted of as probate possessions and pass straight to the recipients. Selecting the ideal executor or trustee is important to the successful implementation of your estate plan. He or she or entity will certainly be in charge of executing your desires, managing your possessions, and distributing them according to your instructions. Select a specific or institution with the essential skills, experience, and honesty to take care of the complexities of your estate.- While you examine whether there is a requirement for a certificate from the neighborhood authority, additionally inquire if you require planning consent.

- While some individuals might feel their job carries little danger of lawsuit, others might pick to position their firm for bigger growth that could bring even more threat.

- Click for a list of words connected to wills and estates and what they imply.

Organizing for the future: Nine keys to becoming a future-ready company - McKinsey

Organizing for the future: Nine keys to becoming a future-ready company.

Posted: Mon, 11 Jan 2021 08:00:00 GMT [source]

Social Links