August 30, 2024

Estate Planning For Local Business Owner New York State Attorney

Everything You Need To Understand About Safeguarding Your Organization In A Divorce To stay legally compliant, you'll require to meet external and inner service compliance needs. The majority of exterior demands involve submitting documentation or paying taxes with state or government governments. The downside of being a single trader is that you have endless obligation, suggesting you are accountable for any financial obligations business has. You might risk your very own individual assets, such as your residence and cost savings if business got involved in economic trouble. Sole investors also find it more challenging to get the funding they need from banks, but maybe the right alternative for you if your company is low-risk and does not need financing.A New California Privacy Law Could Affect Every U.S. Business—Will You Be Ready? - Forbes

A New California Privacy Law Could Affect Every U.S. Business—Will You Be Ready?.

Posted: Sat, 07 Sep 2019 07:00:00 GMT [source]

We Appreciate Your Personal Privacy

You will certainly need to understand who the regulatory authority of your sector is and then locate a means to keep your understanding approximately date to stay certified. As there are so many insurance coverages to consider, it is valuable to go and talk with a neighborhood insurance broker to inspect you have the cover you require. The Organization of British Insurers ( ABI) site has an area to assist you pick the ideal insurance coverage for your service. This is to secure you from any kind of insurance claims a worker could make following a crash or ailment experienced as a result of benefiting you. While the legal procedures covered specify to the UK, the general categories are most likely suitable despite where your company situated. It is not constantly very easy to inform whether you require to visit court or qualify to use a various procedure.If You Possess A Service, You Require A Trust Fund, Also

In this article, we will discuss vital estate planning considerations especially tailored for company owner in New York State. The result was the shares were kept in depend on for the sis, vs. being moved straight. If you have a shareholders arrangement and you're uncertain if it would certainly match exactly how you're dividing up possessions in your will, you may wish to speak with a lawyer or tax obligation expert. Willful is not a professional in this level of estate planning for your company. A will certainly might be a fairly simple record that sets forth your wishes concerning the distribution of residential property; it might also consist of guidelines pertaining to the treatment of minor children. Not just does it handle the circulation of assets and heritage desires, however it may assist you and your successors pay significantly less in tax obligations, fees, and court expenses.- So allow's take a deeper check out what kinds of lawyers you could call for as a business owner.

- Although a will is a keystone of estate preparation, some people might require something much more comprehensive, and, if so, a count on may be beneficial.

- It is deemed to have disposed of its assets on the 21st anniversary of its production and every 21 years afterwards, triggering the capital gains tax each time.

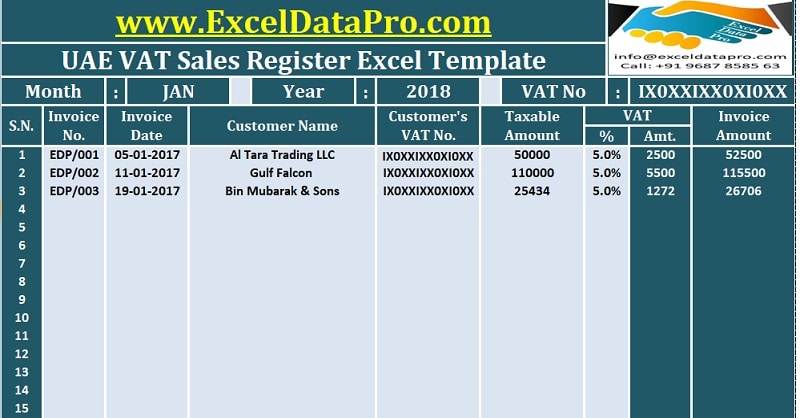

- You can likewise manage this with your accounting software program and include the details to your service monetary statements on a month-to-month basis.

- For tax objectives, single proprietors typically operate under their personal Social Security number, but you can get a Taxpayer Identification Number (TIN) for your business rather.

Social Links