August 12, 2024

Usual Questions In Our Inbox: Discretionary Depends On

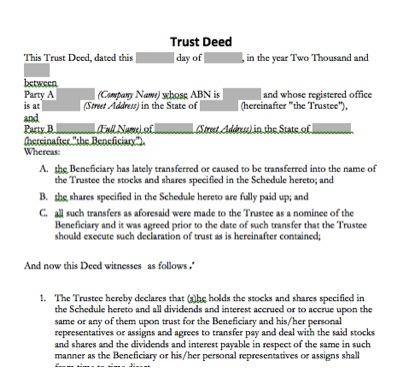

Why Utilize A Discretionary Depend On? One example is that there is no land tax limit exemption for Discretionary Trusts and property can occasionally be kept in a more tax obligation reliable means outside of a Trust fund framework. We do not manage client funds or hold protection of properties, we aid customers connect with pertinent monetary advisors. This kind of depend on can be made use of by settlors that are not happy to give up access to the capital yet desire to begin IHT preparation by cold their obligation on the funding at 40% of the initial premium. Although this type of depend on supplies no IHT advantages for a UK domiciled individual, there are a variety of non-tax benefits which make this kind of count on eye-catching. It is possible for the settlor to be appointed as the protector of the trust fund.'Will my family lose £175k tax break if inheritance money goes into a trust?' - The Telegraph

'Will my family lose £175k tax break if inheritance money goes into a trust?'.

Posted: Wed, 22 Feb 2023 08:00:00 GMT [source]

Use Of A Letter Of Wishes

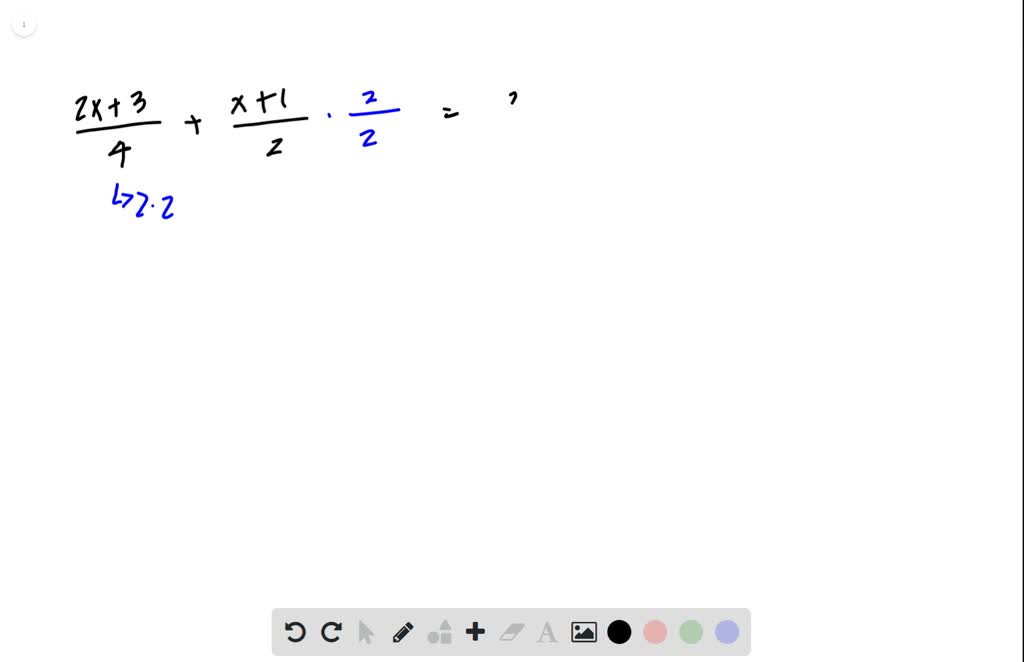

As a result of the intricacy of counts on, it's always suggested Power of Attorney to seek expert specialist advice prior to setting up a trust fund. The entry charge is likewise referred to as the life time charge or immediate charge and is examined when the trust is produced. Gifts into optional depend on are classed as chargeable life time transfers (CLTs). When establishing a new depend on you need to think about any previous CLTs (e.g. gifts right into optional depends on) made within the last 7 years. As long as this total amount does not surpass the settlor's nil price band (NRB) there will be no entry fee. If it is a pair who are setting up the trust you increase up the nil rate band.Just How To Establish A Discretionary Count On

A financial expert can aid you sort via the myriad of estate planning options. Eventually the purpose is to minimise IHT on death but, possibly extra importantly, pass properties to the future generation by means of a trust fund instead of outright. Every one of these trusts will accomplish the latter and the level of IHT performance depends on the option selected. The settlor can give up or delay accessibility to funding payments if they wish, so they can achieve their purposes without needing to make unalterable choices concerning their very own future monetary demands. The gift into the Lifestyle Trust is a Chargeable Life Time Transfer for IHT purposes and if the settlor were to pass away within severn years of declaring the count on the the gift stays part of the estate for IHT objectives. There is also an effect when presents are made in this order, any failed PETs end up being chargeable and affect the calculation at the routine/ 10 annual charge. As a discretionary discounted present count on, there are no called recipients, just a checklist of pre-determined individuals and other lawful entities that might beome a recipient. Keep in mind that the rate calculation is based upon life time rates (fifty percent fatality rate), also if the depend on was set up under the will of the settlor. The rate of tax obligation payable is after that 30% of those prices appropriate to a 'Hypothetical Chargeable Transfer'. When examining the cost appropriate when funds are distributed to a recipient, we require to take into consideration 2 scenarios. The reduced present is thought about a present for IHT functions and if the settlor of the discretionary count on were to pass away within seven years of stating the trust fund after that IHT may schedule. Assuming that the trustees determine to produce an interest free car loan of say ₤ 500,000 from the trust to David, he has satisfaction of the money throughout his life time and, on his fatality, ₤ 500,000 would be repaid to the trust free of IHT. The entire procedure may then be duplicated for subsequent generations subject to the perpetuity duration-- 125 years English Regulation. Remember, this is an unalterable trust fund so the transfer of properties is irreversible. So it is necessary to ensure beforehand that this type of count on is proper for your estate intending needs. It might be handy to go over other trust fund options with an estate preparation attorney or a financial consultant prior to continuing with the creation of an optional depend on. This kind of optional trust includes the settlor as one of the beneficiaries of the trust property. Positioning the properties in a discretionary trust fund protects a beneficiary's share where they are financially unstable. It is common for settlors to use a mix of these options and to establish the planning as they advance with life and circumstances adjustment. Certain trust funds not just enable your customers to hand down riches when they die but can likewise give them access to normal withdrawals when active. Nonetheless, you ought to realize that with trusts designed to attain a tax conserving, your customers typically need to pass up accessibility to at the very least several of the initial funding in addition to any capital growth. Various properties can be put in a trust fund, consisting of financial investments and life assurance policies.- The trustees can make a decision which of the beneficiaries get a circulation, just how much they receive and when they get it.

- This allows the trustee to have discretion over who can take advantage of the trust fund and the quantity of money each recipient would certainly obtain annually.

- It is feasible for the settlor to be designated as the protector of the trust fund.

- Anybody is entitled to buy a duplicate of a Will that has actually gone through the probate process.

What occurs to an optional count on when the trustee passes away?

If a trustee is an individual, the duty generally can not be passed to a follower under the trustee''s Will. In lots of optional trust funds, the trustee has no right to nominate their successor and rather, the appointor (that can select a new trustee) is delegated determine who comes to be the new trustee of the trust fund.

Social Links