August 8, 2024

Pour-over Will Certainly Wex Lii Lawful Info Institute

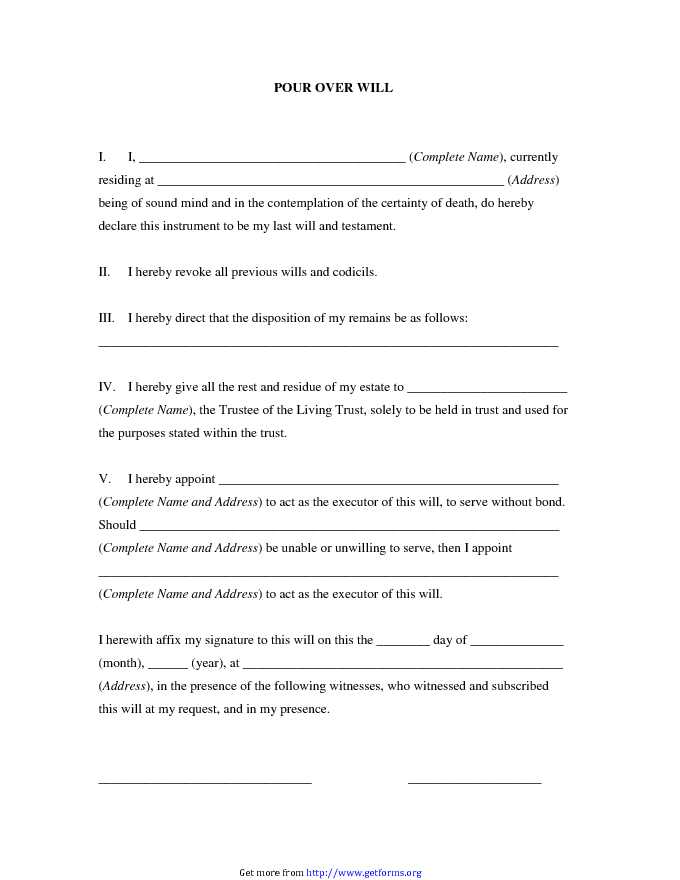

Pour-over Wills Trusts can offer tax advantages, privacy and several other advantages that Estate Planning professionals view as valuable and worthwhile. If you just have a basic Will (instead of a Pour Over Will), any kind of properties in there would certainly not have the ability to profit that Living Count on possessions do. A joint pour-over count on holds you and Types of Wills your partner's collectively owned residential property and accounts. You and your partner work as co-trustees of the trust and manage the home and accounts. There are some crucial distinctions between a revocable and an irrevocable count on past that a revocable trust can be altered yet an irreversible trust fund can not be transformed.Stanley Paperless Pour Over Coffee Dripper - HYPEBEAST

Stanley Paperless Pour Over Coffee Dripper.

Posted: Tue, 25 Aug 2020 07:00:00 GMT [source]

Do Pour-over Wills Go Through Probate?

A living trust fund permits you to stay clear of probate and transfer possessions through the depend on administration process, yet you should transfer cash and residential property into the depend on. If you have building that you failed to move during your life time, you can utilize a pour-over will to ensure it is moved to the trust fund upon your fatality. A living trust, or a revocable trust fund, is frequently utilized as part of an estate plan. During your lifetime, you can create the trust fund and transfer possession of properties to it. You can be the trustee while you live and of sound mind and can name a back-up trustee who will take control of administration of trust properties when you end up being incapacitated or pass away. When you set up a living trust fund, you are developing a separate legal entity that has its own assets.Added Property

UTATA particularly determines that any type of probate assets transferred to a living depend on be treated identically to other possessions in the count on, therefore conserving the probate court substantial time and price. Some territories call for that if the trust fund document is changed, the pour-over will must additionally be republished, either by re-execution or codicil. In these jurisdictions, if the trust fund is revoked by the testator and the pour-over condition is neither changed neither deleted, the pour-over gift lapses.- Please call us if you wish to talk about the contents of this website in much more information.

- Due to the fact that she just receives quarterly statements from that account and isn't actively collaborating with it, the pension completely slid her mind when establishing her living trust.

- If you have a last will and testament, the non-trust assets will be dispersed according to the arrangements of that paper.

- The distinction in between a simple will certainly and a pour-over will is that a simple will certainly is suggested to handle your entire estate, such as by leaving it to your spouse or your children.

I Have A Revocable Trust Fund, I Thought That Is All I Require?

By doing this, your will certainly is currently on data and with the the clerk if it's later uncovered that you have possessions needing probate. When you produce a Will with a relied on firm like Count on & Will, you'll instantly obtain a Pour Over Will as component of our detailed Estate Planning procedure. This way, you're currently set up to make use of the benefits of having a Count on, and you'll have a Will in place that ensures absolutely nothing is failed to remember. The probate procedure utilized for a given estate depends on the dimension and complexity of the estate. If your pour-over will needs to transfer only a small amount of residential or commercial property to one beneficiary (the trust), a simplified probate process is probably all that will certainly be needed, with little or no court participation. Estate plans normally set pour-over wills with living depends on, which require that grantors transfer properties to them before their fatality. In putting together your estate strategy, one choice you may seek is establishing a revocable living trust fund. During your lifetime, you can access the assets in this sort of trust fund and also make updates to it as required. A revocable living trust likewise helps your enjoyed ones prevent the taxing process of probate when you pass away. Must you go this route, you might consider setting up an associated paper referred to as a pour-over will also. A pour-over will certainly is a last will and testament that functions as a security tool to record any type of assets that are not transferred to or consisted of in a living trust. While "funding" a living trust fund can be an easy procedure, often properties do not always make it to the trust fund for a variety of factors.Can an enduring spouse modification a mirror will?

Social Links