August 9, 2024

Just How To Establish A Discretionary Trust Fund

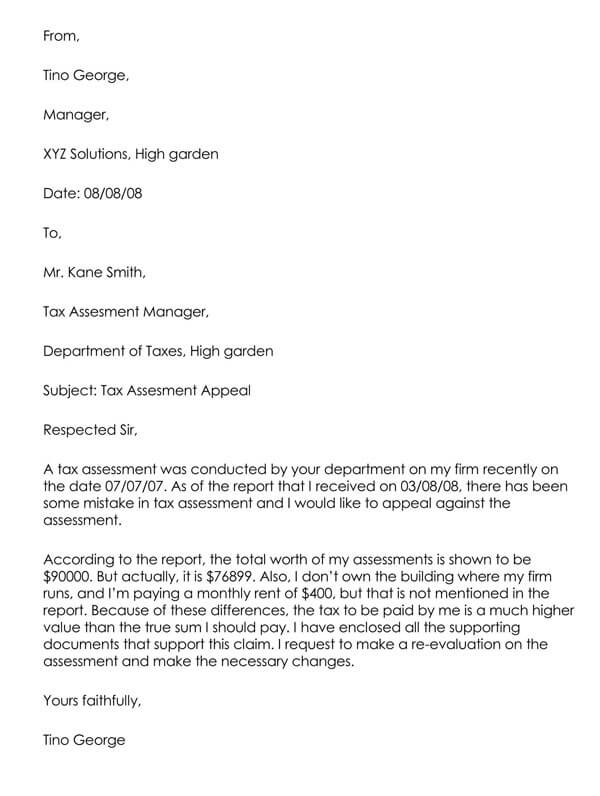

Discretionary Depend On Wex Lii Lawful Information Institute The court held that their optional powers continued, which they ought to exercise it in respect of the dormant years now as they need to have done at the time. The court declared that if trustees decline to distribute earnings, or refuse to exercise their discernment, although the court might not compel it be exercised in a certain way, it might get that the trustees be replaced. It is very important to keep in mind that letters of desires are not a legitimately binding document and for that reason there is no obligation positioned on the trustees to follow them. Becoming part of a trust can be difficult to navigate with the various lawful and tax obligation requirements. However, it can be an extremely beneficial method to manage and safeguard your assets.Judge ruling: “You are no Mother Teresa and no one goes to Cayman for philanthropic reasons” - Tax Justice Network

Judge ruling: “You are no Mother Teresa and no one goes to Cayman for philanthropic reasons”.

Posted: Thu, 13 Aug 2020 07:00:00 GMT [source]

Objectives

It is also helpful where the beneficiary has a drink, medicine or betting problem and the testator does not want to gift the monies to them directly for fear it can exacerbate their dependency. This mechanism enables you to ringfence some or all of your Estate, commonly to support an enjoyed one that is at risk or not able to manage their own affairs. Or securing cash or assets for loved ones undergoing a separation or a duration of economic instability.An Overview To Will Trusts

A well-drafted optional depend on permits the trustee to include or leave out recipients from the class, offering the trustee better flexibility to attend to adjustments in conditions. The trust is optional due to the fact that the trustee has the discernment to offer or deny some advantages under the trust. The beneficiaries can not oblige the trustee to use any one of the depend on property for their benefit. He or she will take care of the trust and ensure that the possessions are distributed according to your wishes. The trustee must be someone whom you trust to make wise decisions concerning that need to obtain cash from the count on and how much they must receive.Optional Trust Entry Fee

As an optional reduced present trust, there are no named beneficiaries, simply a checklist of pre-determined individuals and other legal entities who may beome a recipient. Note that the price calculation is based on lifetime prices (half fatality rate), also if the depend on was established under the will of the settlor. The price of tax payable is after that 30% of those rates applicable to a 'Hypothetical Chargeable Transfer'. When evaluating the cost applicable when funds are distributed to a beneficiary, we need to consider 2 scenarios. There is no IHT fee on the Benefits of Having a Will presents however they do eat up some of his NRB which decreases what can be made use of versus the remainder of his estate. Lastly, you'll need to fund the count on by moving ownership of the properties right into it. Once everything is in area, the discretionary trust fund will prepare to run. Additionally, Missouri estate law avoids a creditor from forcing a trustee to make a distribution to the recipient or attaching an interest to the money in the optional depend on with a judgment or other methods. Welcome to the 4th in a brand-new collection of articles from the SWW Technical Team; Common Concerns in our Inbox. Where the discretionary trust fund is a testamentary trust, it is common for the settlor (or testator) to leave a letter of wishes for the trustees to lead them regarding the settlor's desires in the exercise of their discernment. An optional trust can last for a maximum of 125 years; for that reason, it is necessary to consider that the default recipients will be i.e. those who will certainly acquire the count on fund when the trust fund ends. Please see our earlier article laying out the typical mistakes when drafting an optional trust. The depend on can finish earlier in instances where every one of the beneficiaries have died, or if the trustees have actually decided to relax the trust fund and distribute the trust fund properties as necessary. What's unique regarding discretionary depends on is that the beneficiaries are classified just as prospective beneficiaries. They do not end up being actual beneficiaries till the trustees choose to pass funds to them. Helen makes a gift of ₤ 400,000 into a discretionary count on for the advantage of her kids and grandchildren when the NRB is ₤ 325,000. She has never ever done trust fund preparation before and this is her first count on, nonetheless she does use her ₤ 3,000 yearly exception annually. If the CLT exceeds the settlor's available NRB there is a prompt fee of 20% on the quantity over.- As a matter of fact, the beneficiaries of a discretionarytrust have no rights to its funds and these funds are not considered part ofthe beneficiaries' estates.

- Initially, the trustees normally have the power to determine which recipients (from within the course) will certainly obtain repayments from the count on.

- A financial consultant can assist you arrange with the myriad of estate planning choices.

- Formerly, it had been understood that for the trust to stand, the trustees had to be able to draw up a "total checklist" of all the possible beneficiaries, and if they might refrain from doing so, the count on was void.

- In addition to an optional recipient, various other kinds of beneficiaries exist and can be named to accounts.

- In addition to the reduction of the settlor's estate for IHT functions, a more IHT advantage can arise by making certain some properties pass outside of a partner's ownership, which in time will alleviate IHT on the second fatality.

What happens to a discretionary trust fund on death?

Social Links