August 7, 2024

Optional Count On Wex Lii Legal Information Institute

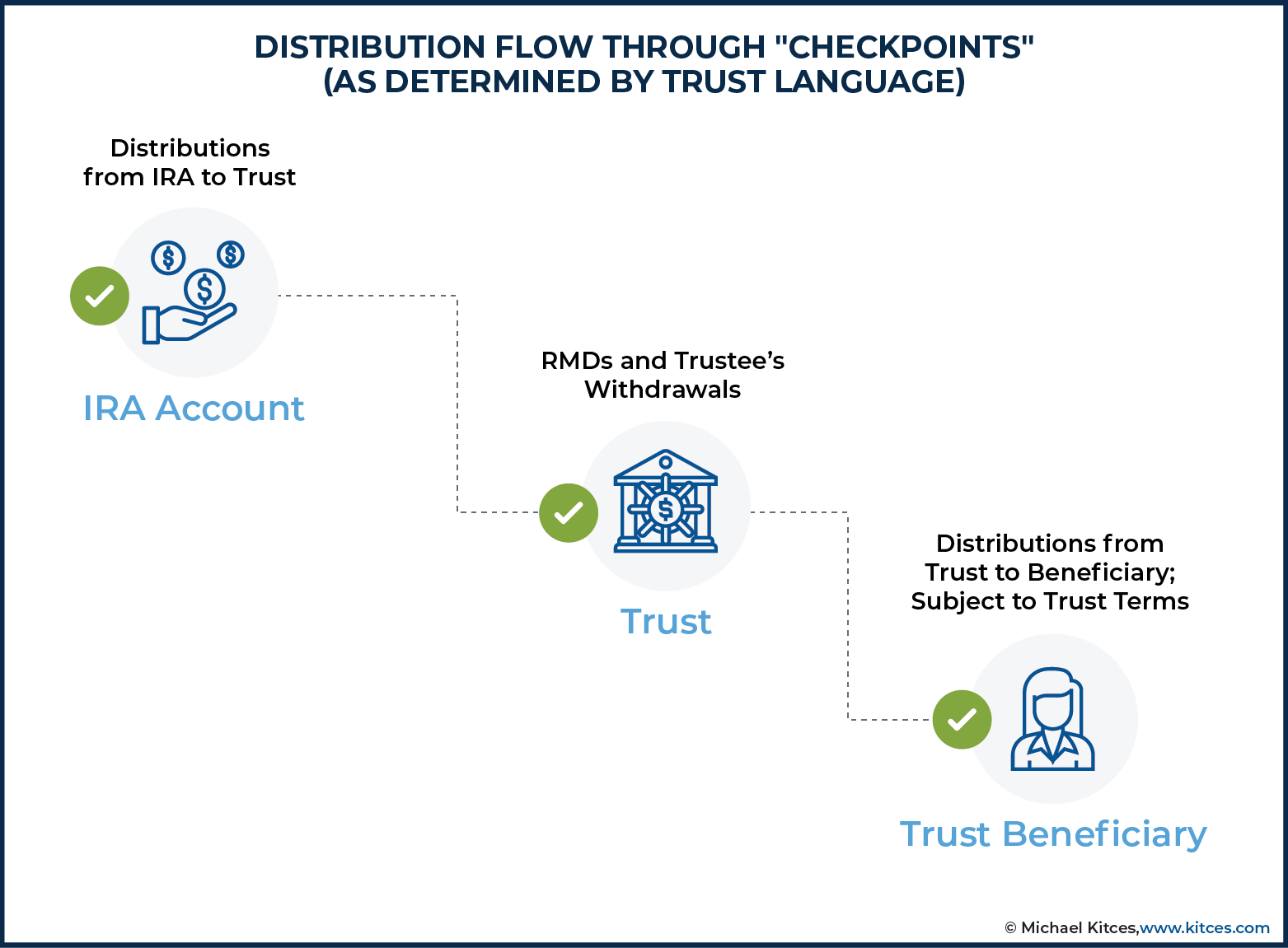

Optional Depend On Wex Lii Lawful Details Institute Nonetheless, in situations where a settlor is also a recipient, the recipient might be strained on any earnings occurring to the trustees. An optional trust fund can be created when the settlor lives, or in their will. Discretionary counts on can appear unusual presumably yet there are lots of reasons that they might be a vital part of your estate planning. The ATO describes Trusts as "a specifying attribute of the Australian economic situation" and has estimated that by 2022 there will be over 1 million Rely on Australia.- Consequently, the recipients have no rights to the funds held in the Depends on.

- There can also be a course of people that are selected as the optional recipients i.e. youngsters or grandchildren.

- The trustees have a wide variety of powers and are given total control over the assets within the depend on.

What Are The Downsides Of An Optional Trust?

Consider a circumstance where the settlor declares a discretionary count on of say ₤ 1 million. A variety of years later on he is getting divorced and has actually Find more info been asked to state all his properties. The settlor does not state the count on fund as this is no longer a property he is the lawful owner of.Benefits And Drawbacks Of Setting Up An Optional Count On

It's a family affair - family trusts in family law - Lander & Rogers

It's a family affair - family trusts in family law.

Posted: Thu, 30 Apr 2020 15:53:05 GMT [source]

Wepc Wills Probate Will Creating Leicester Will Certainly Creating Solutions London Long Lasting Power Of Attorney Uk

Get in contact with a member of our team today for a cost-free legal consultation and see how Lawful Kitz can help you. Possession security is a vital benefit of establishing a count on fund, so it's important to cover the best ones with the assets held in your count on. For some families, a Discretionary Trust likewise works as a structure where they can assign financial resources to a family member who have special clinical or way of living demands and can't attend to themselves. Depend on revenue can be a reliable legal entity to support future generations or household business. You have miraculous trust in him, and recognize that he will certainly disperse the funds sensibly. In the case that your little girl regressions or otherwise is showing reckless behavior, your Trustee can quit dispersing funds at his discernment till she comes back on the best track once more. Because the trustees have a lot of power, you might intend to give some standards for them to comply with. This can be achieved by leaving a letter of dreams in addition to your will, laying out the situations in which you would like your recipients to receive their properties. It's worth taking the time to learn more about exactly how a Discretionary Trust fund works. Due to the fact that beyond simply providing for count on beneficiaries, this legal structure might have benefits for your very own personal scenarios, monetary scenario and estate preparation requirements. Do you intend to ensure that all your possessions will ultimately pass to your children? Find out even more concerning developing a living trust that permits you to move your possessions or home quickly. When initially discussing the choice of a depend on or count on fund to several customers, it conjures thoughts of 'Panama documents' design planning given the limelights got throughout the years. The tax benefits of counts on have slowly been deteriorated with time, beginning in 2006 when Gordon Brown revealed significant reform to trust regulation and taxes. Where the optional count on is a testamentary count on, it is common for the settlor (or testator) to leave a letter of yearn for the trustees to assist them as to the settlor's wishes in the exercise of their discretion. An optional depend on can last for an optimum of 125 years; therefore, it is very important to consider that the default recipients will certainly be i.e. those that will certainly acquire the trust fund when the depend on finishes. Please see our earlier write-up laying out the common mistakes when drafting an optional count on. The trust fund can finish earlier in instances where every one of the recipients have died, or if the trustees have decided to relax the trust and distribute the count on properties accordingly. What's unique about optional trust funds is that the beneficiaries are categorized just as possible recipients. They do not become actual beneficiaries up until the trustees choose to pass funds to them. They must acquire and consider appropriate guidance from an individual certified to give such recommendations and must also branch out the investments. The trustees can entrust their powers of financial investment to an expert asset supervisor. The function of the trustee( s) is to hold and provide the count on possessions for the usage and advantage of the recipients. The role does require a specific quantity of participation and adherence to basic trust fund regulation and the details regards to the depend on. As an example, "my grandchildren" can include all the grandchildren that may be born in the future. From tax planning to family business and property protection, these forms of household counts on are an effective means to disperse income and assets held in your estate. First, the trustees usually have the power to identify which beneficiaries (from within the course) will certainly obtain payments from the count on. Second, trustees can select the amount of trust fund home that the beneficiary obtains. Although a lot of discretionary counts on enable both types of discernment, either can be enabled on its own. A discretionary trust is a sort of trust that can be developed in behalf of several beneficiaries.What is the one decade charge on an optional will trust?

s)might control the properties they do not really have them (they're had by the trustee of the depend on). Recipients left out might feel aggrieved.Loss of control. The trustees can overlook the settlor's wishes.Trusts can be pricey to set up and run.As with all trust funds an optional trust fund requires to be effectively provided. A Discretionary Will Trust Fund

Social Links