August 21, 2024

Put Over Wills Under The Law Estate Planning Lawful Facility

Texas Pour-over Wills Overview Massingill Irrevocable trusts get rid of the benefactor's taxed estate properties, indicating they are exempt to inheritance tax upon death. If the depend on is a guarantor trust, the developer of the depend on covers the income tax of trust possessions, and the beneficiary will not owe earnings tax obligations on distributions. If the trust fund is not a guarantor depend on, the trust fund pays revenue tax obligations on its assets while they remain in the trust fund, and the beneficiary will certainly owe revenue tax obligations on distributions.Does The Pour-over Will Require To Go Through Probate?

- Much of the leading Jacksonville estate-planning attorneys utilize a Florida Pour Over Will to enhance a revocable, living, or irreversible trust.

- There are some key distinctions between a revocable and an unalterable trust beyond that a revocable depend on can be altered yet an unalterable count on can not be altered.

- The benefactor, having actually transferred possessions right into an irreversible trust, properly gets rid of all civil liberties of ownership to the properties and, generally, all control.

- The trustee will certainly adhere to the guidelines you left in the trust fund file.

- If you've checked out creating a revocable living trust to avoid probate, you may have become aware of a "pour-over will." This sort of will is typically made use of with a living count on.

Do Pour-over Wills Experience Probate?

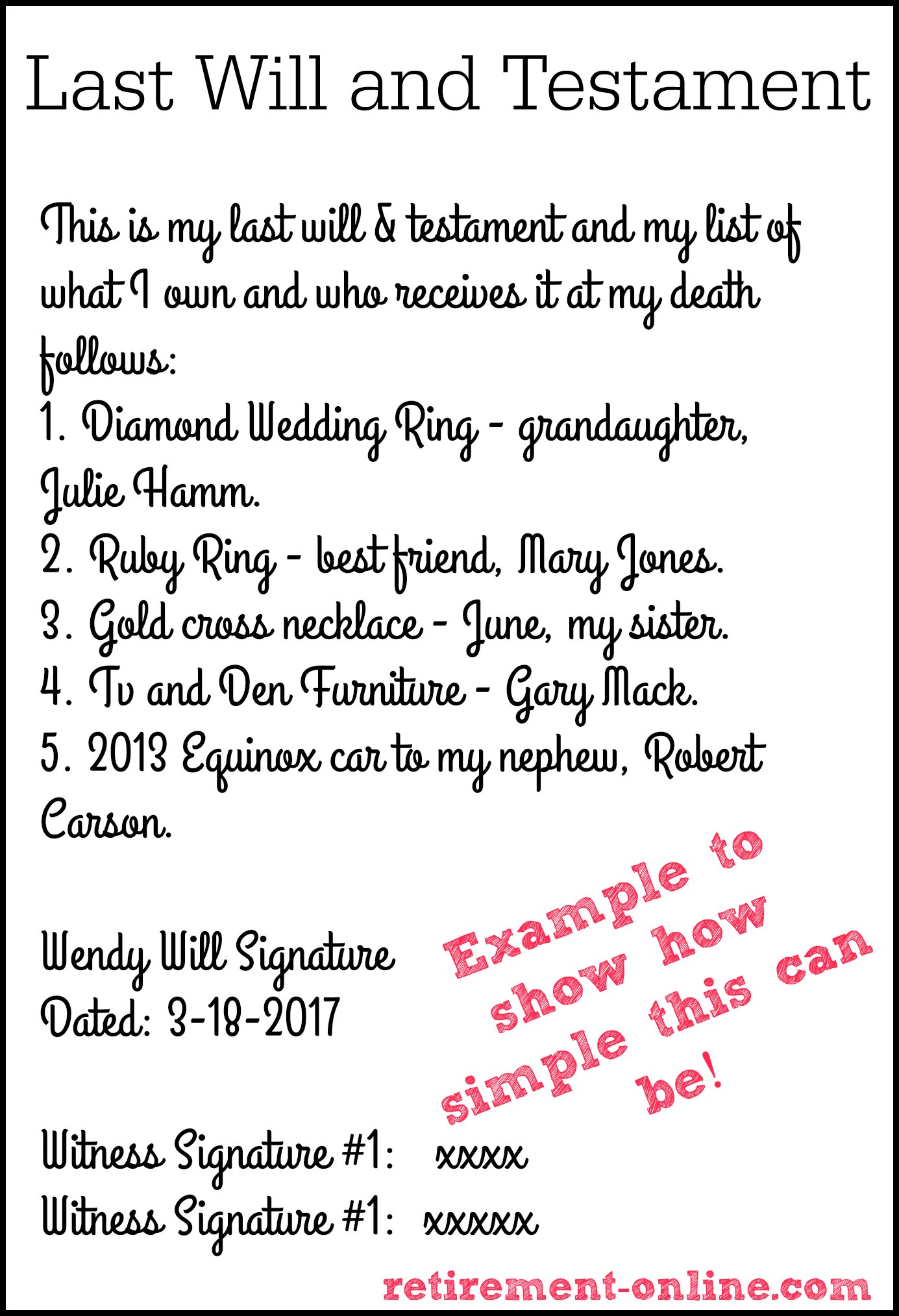

Similar to any various other last will and testimony, a pour-over will certainly must be signed by the number of witnesses needed by your state's laws (typically, you will certainly need 2 witnesses). This is a sort of will which contains a provision to "pour over" any kind of recurring estate assets right into a living depend be managed by a trustee upon the testator's death. While among the key purposes might be that the trustee moves the properties into the hands of beneficiaries asap, the trustee's role may be more made complex in particular conditions. For example, the count on paper may consist of terms for taking care of assets of young children or those with special needs. Along these lines, a trustee might be routed to leave assets in the trust until a youngster reaches a specified age. This enables recap probate treatments, which are much cheaper and faster than official probate procedures. Rather, the pour-over will certainly route that these properties most likely to the trust and be dispersed according to the grantor's objectives-- though not always as promptly as if they had actually remained in the trust to start with. You might have seen recent news insurance coverage of clients of monetary solutions business coming down with social design rip-offs. Fraudsters pose a relied on firm to convince their targets right into revealing or handing over delicate information such as insurance, financial or login credentials. This scamming can occur using message, email or websites established to appear like the relied on Avoiding Probate firm. Collaborating with an attorney to draft this paper can likewise be valuable to guarantee you fulfill all demands to develop a valid will so your directions are followed upon your fatality. When you create a living trust fund, you must fund it by re-titling properties so the count on ends up being the official proprietor. But it is extremely possible that you will refrain this with whatever you have. Keep in mind that if you keep back just products of small value for the pour-over component of the will, your family members might benefit from an expedited process. In some states, your estate may get approved for "tiny estate" probate, frequently referred to as "recap probate." These procedures are less complicated, quicker and less expensive than regular probate. In several states, your will have to be deposited with your state court clerk's workplace within a specific timeframe following your fatality. The pour-over will form should be consistent with the count on and may call the trust fund as a recipient. Make sure that naming the trust as the beneficiary has no unfavorable tax obligation effects by reviewing your specific scenario with a certified public accountant. In 2002, Gabriel Katzner, the founding partner of Katzner Legislation Group got his Juris Doctorate with honors from the Fordham College College of Legislation. After investing the very first 7 years of his lawful careerpracticing at Cahill Gordon & Reindel LLP, a worldwide law firm based in New york city, he went on to discovered his very own company. But they will likely contain fewer properties than a normal will, or assets of significatively much less value. Naturally, whenever you compose a pour-over will, you still have the choice to grant presents to private liked ones. Nonetheless, the pour-over will consists of exact lawful language suggested to profit your trust fund. In Texas, pour-over wills lug the exact same demands as any type of other will to be legitimately acknowledged and enforceable.B.C. Supreme Court judge issues ruling involving the estate of former Canucks president Pat Quinn - The Georgia Straight

B.C. Supreme Court judge issues ruling involving the estate of former Canucks president Pat Quinn.

Posted: Tue, 13 Mar 2018 07:00:00 GMT [source]

Does a put over will avoid probate in Florida?

likewise a public procedure. Among the factors numerous individuals pick to make use of living Count on their estate planning is as a result of their ability to prevent probate. Nonetheless, all Wills, consisting of pour-over Wills, have to undergo the probate procedure. You can minimize that via using a purposefully malfunctioning grantor depend on, or IDGT

Social Links