August 7, 2024

Revocable Count On Vs Irreversible Trust: What's The Difference?

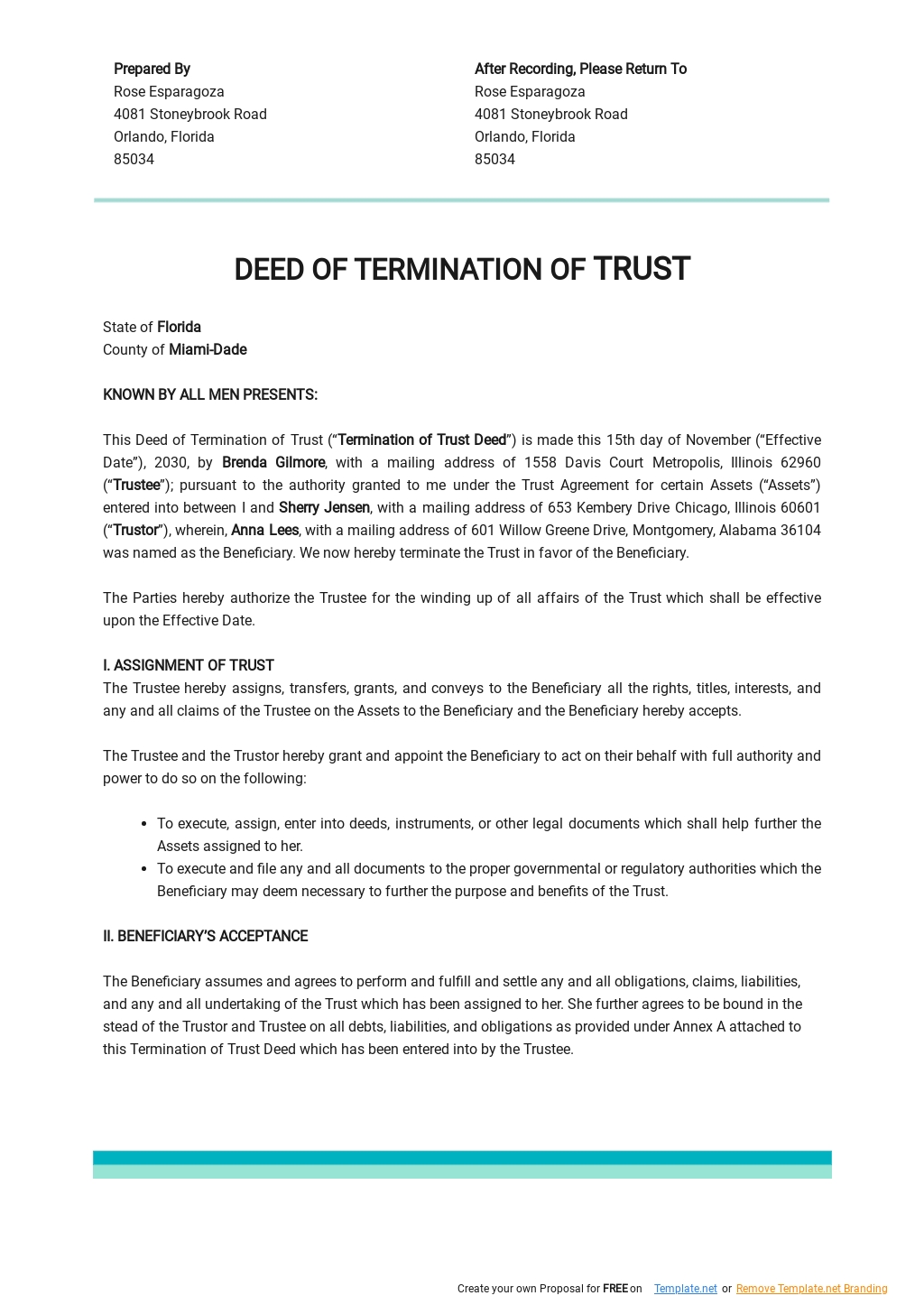

Pour-over Wills Counts on can supply tax obligation advantages, personal privacy and many various other benefits that Estate Preparation specialists view as valuable and rewarding. If you simply have an easy Will (as opposed to a Pour Over Will), any type of assets in there would not have the ability to profit that Living Trust assets do. A joint pour-over trust holds you and your partner's jointly owned residential or commercial property and accounts. You and your partner work as co-trustees of the count on and manage the residential property and accounts. There are some essential differences in between a revocable and an unalterable depend on past that a revocable trust fund can be modified however an irrevocable trust can not be transformed.Recent Changes to Pour Over Rules - Clark Wilson LLP

Recent Changes to Pour Over Rules.

Posted: Wed, 17 Jul 2019 07:00:00 GMT [source]

Regarding Living Trusts

It likewise shields assets from lenders in claims, and assets are exempt to estate taxes. If you're considering establishing one, speak with a certified depend on lawyer. A put over will certainly deals many advantages Legal Rights and Will Writing for estate planning with one of the advantages being that the pour over will certainly assists to use the revocable or unalterable counts on that an individual produces. A Florida Living Trust fund is another terrific device that allows a person's residential property to bypass the probate procedure when she or he passes away.Pour-over Wills And Counts On

UTATA especially determines that any type of probate possessions moved to a living count on be treated identically to other properties in the depend on, hence saving the probate court substantial time and expense. Some jurisdictions need that if the depend on document is amended, the pour-over will certainly must also be republished, either by re-execution or codicil. In these jurisdictions, if the depend on is withdrawed by the testator and the pour-over stipulation is neither amended nor deleted, the pour-over gift lapses.- The Pour-Over Will can make sure that your any possessions included in your probate estate are routed to your Revocable Depends on.

- When they pass, their trust fund is kept out of probate, and the specifications in their trust can be accomplished quietly.

- They can remove recipients, mark new ones, and customize terms on just how possessions within the trust fund are managed.

- The probate procedure utilized for a given estate depends on the dimension and intricacy of the estate.

What's the point of a put over?

Social Links