August 16, 2024

Recognizing How Optional Trust Funds Function

What Is A Discretionary Trust? Interpretation & Frequently Asked Questions It's clear that Discretionary Depends on comprise a significant percentage of that number due to their appeal for company, financial investment and estate preparation. Trustees that are unable to offer an excellent reason for a refusal will run the risk of being directly accountable for Court prices, should a conflict get to that point. Additionally, beneficiaries can put on the Court to have the trustee eliminated or replaced.Jenny Walsh Partnerwills, Probate And Challenged Estates

- Before you decide regarding your estate planning, it is necessary to learn about the negative aspects of a discretionary depend on.

- There are some even more important reasons that these trusts can be tax effective.

- The beneficiaries do not have any privilege to the trust fund hence it does not develop part of their estate on divorce, bankruptcy or fatality.

What Are The Benefits Of Optional Counts On?

FATCA fact: Under new US tax law, Indian Trusts will now have to disclose details to Internal Revenue Service - The Economic Times

FATCA fact: Under new US tax law, Indian Trusts will now have to disclose details to Internal Revenue Service.

Posted: Fri, 30 Oct 2015 07:00:00 GMT [source]

How Do I Established An Optional Count On Missouri?

One example is that there is no land tax obligation limit exemption for Discretionary Trusts and realty can in some cases be kept in an extra tax obligation effective way outside of Testamentary Will a Count on structure. We do not manage customer funds or hold custody of possessions, we aid individuals connect with relevant financial experts. This type of depend on can be utilized by settlors that are not going to give up access to the resources yet desire to start IHT preparation by freezing their responsibility on the resources at 40% of the initial costs. Although this kind of depend on uses no IHT advantages for a UK domiciled private, there are a variety of non-tax benefits which make this sort of trust attractive. It is feasible for the settlor to be appointed as the protector of the trust fund. Property protection is an essential benefit of establishing a trust fund, so it is very important to cover the best ones with the possessions kept in your depend on. For some households, a Discretionary Count on likewise acts as a framework through which they can assign funds to a relative that have unique medical or way of life requirements and can't attend to themselves. Trust fund income can be a reliable legal entity to sustain future generations or family company. A vital element which identifies Discretionary Trusts, however, is that they operate while vital relative are living and can have a say in how they're handled. Working with an advisor might feature possible downsides such as settlement of charges (which will certainly minimize returns). There are no assurances that working with an adviser will yield favorable returns. The trustees can determine which of the beneficiaries receive a circulation, how much they get and when they get it. It is necessary that trustees are individuals you depend on, as you essentially hand all decisions over to them. Optional counts on are a type of irreversible depend on, implying the transfer of possessions is long-term. When somebody develops an optional trust they can name a trustee and one or more follower trustees to supervise it.When to make use of discretionary trust fund?

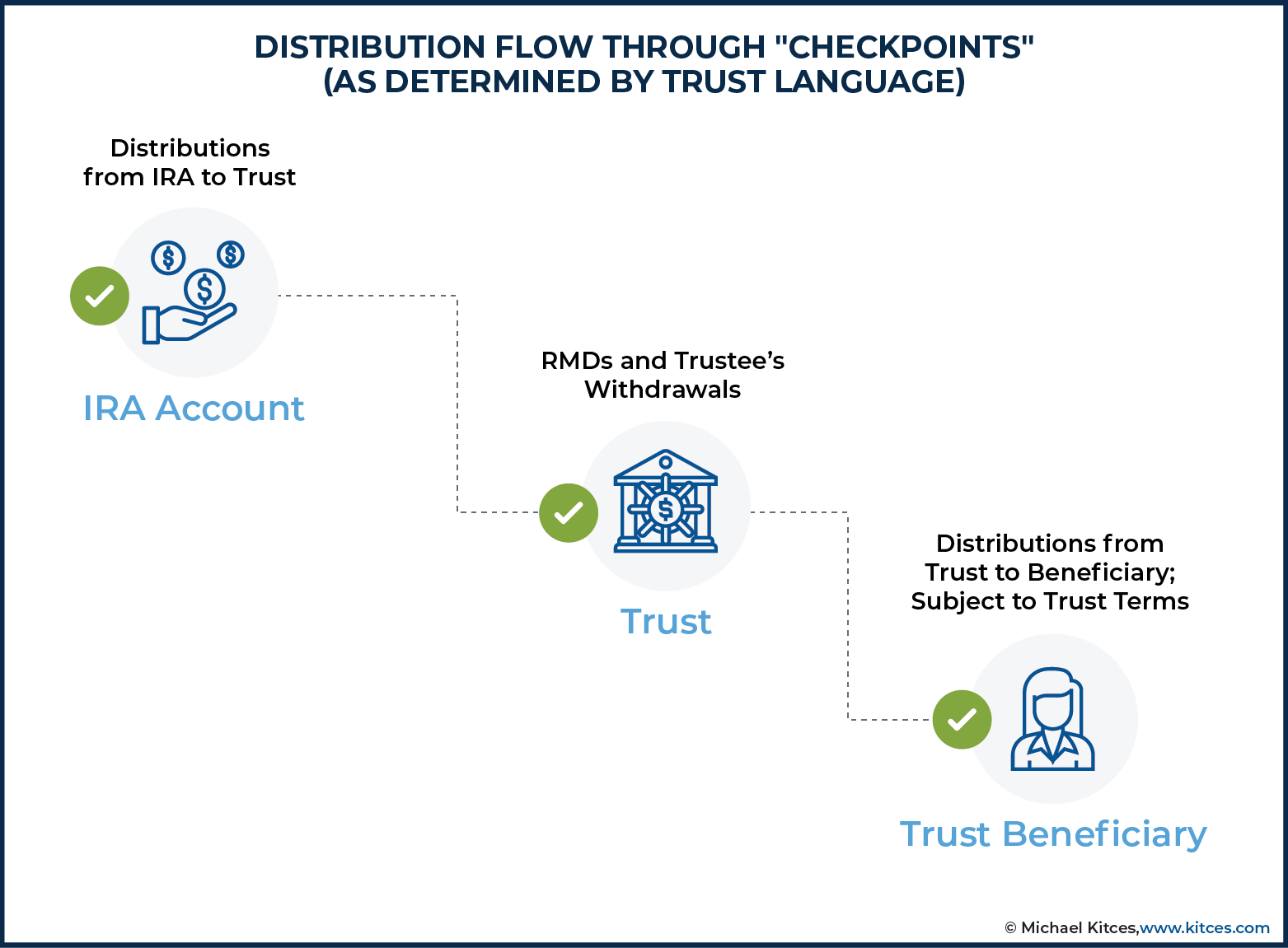

A discretionary count on divides possession from control. Possession by the trustee for the recipients of the family members trust fund maintains properties out of injury''s means from any type of claims against a person. This is also where the person may, as director of the trustee business, manage the trustee!

Social Links