August 16, 2024

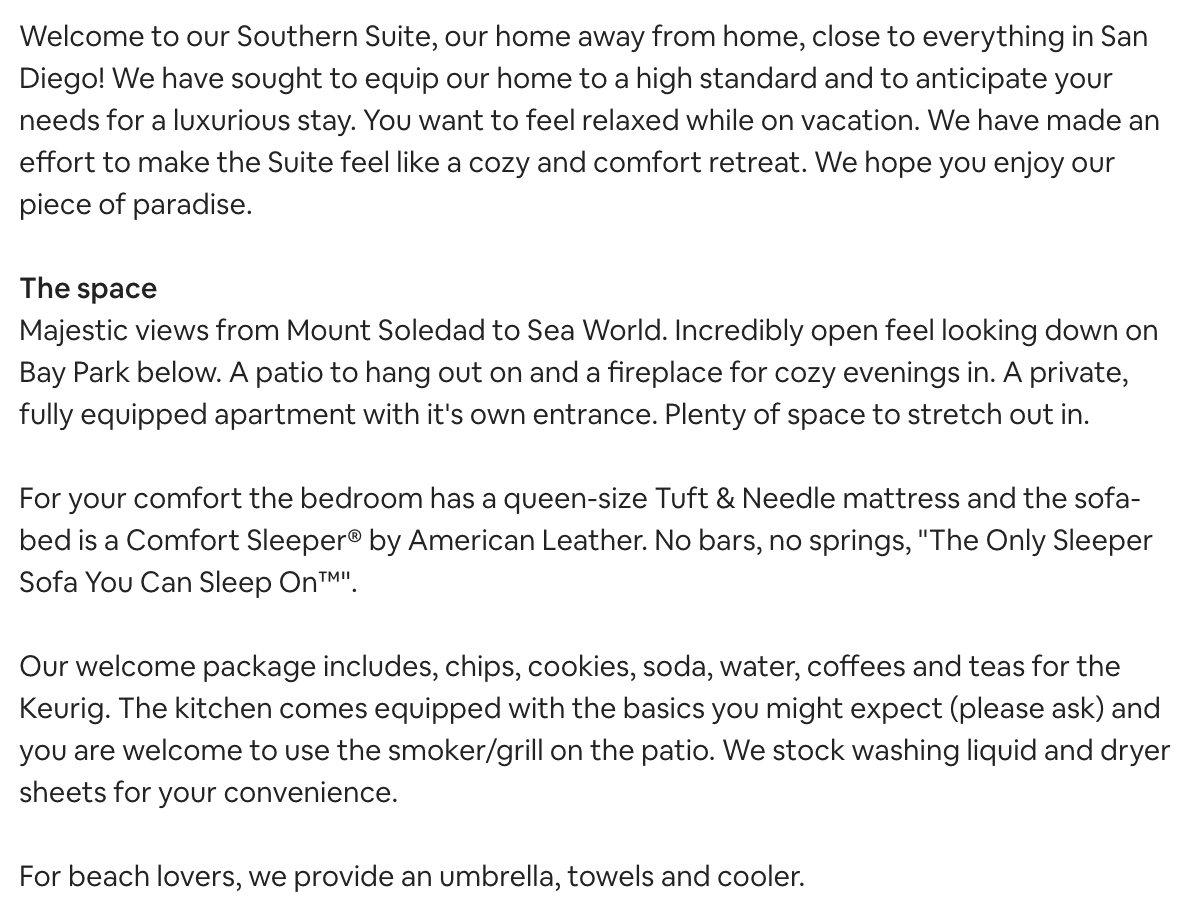

Optional Count On Wikipedia

The Function Of Discretionary Rely On Your Will A monetary expert can assist you arrange via the myriad of estate preparation choices. Inevitably the purpose is to minimise IHT on death yet, possibly much more notably, pass properties to the next generation via a trust fund rather than outright. Every one of these trust funds will accomplish the latter and the degree of IHT efficiency depends upon the alternative selected. The settlor can give up or delay access to funding repayments if they wish, so they can attain their objectives without needing to make irrevocable choices regarding their own future monetary needs. The gift into the Way of life Depend On is a Chargeable Life Time Transfer for IHT functions and if the settlor were to die within severn years of declaring the count on the the gift remains component of the estate for IHT objectives. There is also an effect when presents are made in this order, any failed PETs end up being chargeable and impact the calculation at the periodic/ 10 yearly charge.Kinds Of Optional Trusts Offered From Quilter

- Permitting them to shield count on residential or commercial property and assets, reduce tax obligation, and extra flexibly intend their monetary affairs and earnings.

- Note that the price estimation is based on lifetime rates (fifty percent death price), even if the depend on was established under the will of the settlor.

- When the trustees of the discretionary trust determine the periodic/10 yearly fee ten years after set up of the discretionary depend on, the unsuccessful PET is currently a chargeable transfer and is included into the calculation.

- Any financing from the trust to a recipient ought to be recorded properly and using a. loan contract.

What Are The Benefits Of Optional Depends On?

Discretionary trusts used to acquire Victorian residential property –… - Maddocks

Discretionary trusts used to acquire Victorian residential property –….

Posted: Wed, 22 Apr 2020 07:00:00 GMT [source]

What Is A Discretionary Trust Fund?

An affordable gift trust fund is a depend on which enables clients to give away properties for IHT objectives, whilst still maintaining a right to take routine withdrawals throughout their lifetime. The worth of the gift (the costs paid to the bond) is possibly marked down by the value of this preserved right (in standard terms, the right to get withdrawals is valued) to reduce the responsibility to IHT instantly. Under the finance trust plan a settlor selects trustees for an optional click here depend on and makes a funding to them on an interest-free basis, repayable on demand. The trustees then generally invest the money right into a single premium bond (life guarantee or resources redemption variation) for the trustees. The loan is repayable to the settlor on demand and can be paid on an ad hoc basis or as regular settlements (withdrawals). A discretionary trust can be utilized to guarantee agricultural building alleviation or company residential or commercial property relief is made use of. This could suggest that trustees have the flexibility to adapt the cash paid to recipients in accordance with their altering needs and so on. Please note that all views, remarks or point of views expressed are for info just and do not make up and ought to not be interpreted as being extensive or as giving lawful suggestions. No one ought to look for to count or act upon, or avoid acting on, the views, comments or opinions expressed here without first getting expert, professional or independent guidance. While every initiative has actually been made to make certain accuracy, Curtis Parkinson can not be held responsible for any type of errors, omissions or inaccuracies. If you would certainly like help establishing a Discretionary Count on, or any type of various other kinds of Trust funds, we are right here to aid! Nonetheless, the trustees are needed to act in the very best rate of interest of the depend on and therefore they can reject this request. Where a primary residence passes to an optional count on, the RNRB will certainly not use. Figure out more regarding exactly how to supply your kids with financial security throughout their lifetime. At Standard Wills and Legal Provider, we truly appreciate educating individuals on the value of making an enduring power of lawyer in Leicester. In an industry often loaded with complicated lawful lingo and a conveyor-belt mentality, we supply a standard change in exactly how we provide our wills services. For that reason, the beneficiaries' benefits will be proportional to their "devices", contrasted to the shares in a firm. An optional count on enables trustees to allocate revenue and funding from the trust fund entirely at their discernment. They can determine that must benefit from the depend on, when and in what percentage. This means there's far more versatility and funds can be paid out or withheld as conditions transform. Continue reading to find everything you need to understand on establishing a discretionary trust act.What are the benefits of a discretionary trust in a will?

Social Links